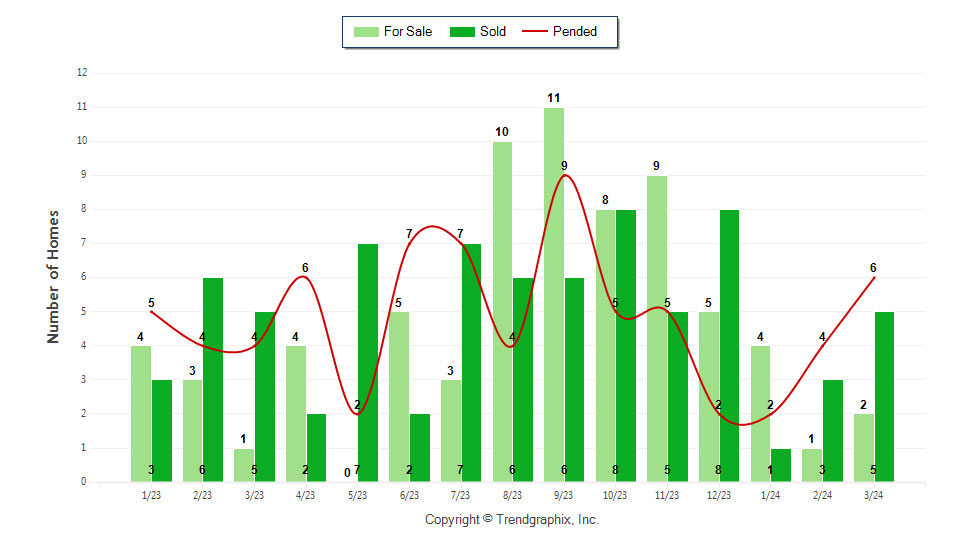

March 2024 was a Seller's market! The number of for sale listings was up 100% from one year earlier and up 100% from the previous month. The number of sold listings was the same year over year and increased 66.7% month over month. The number of under contract listings was up 50% compared to previous month and up 50% compared to previous year. The Months of Inventory based on Closed Sales was 0.4, up 100% from the previous year.

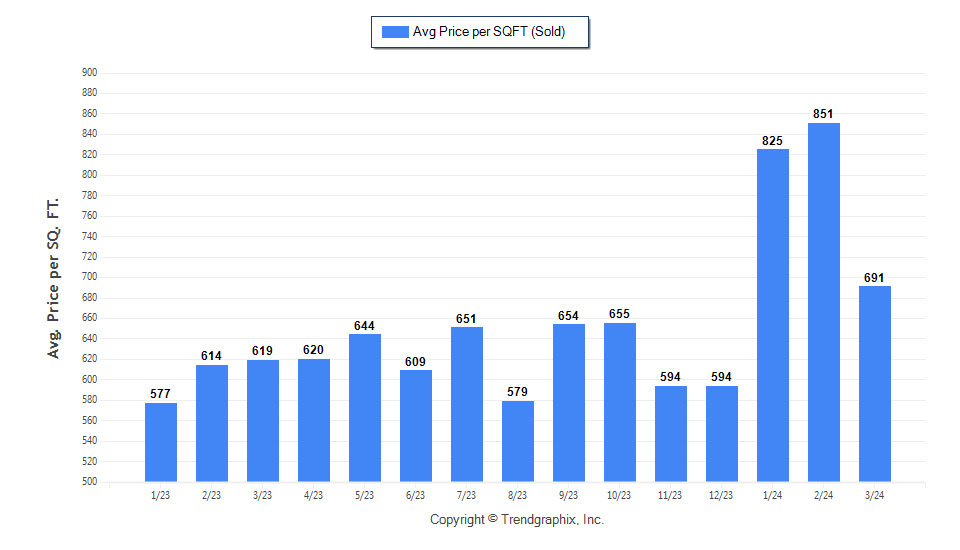

The Average Sold Price per Square Footage was down 18.8% compared to previous month and up 11.6% compared to last year. The Median Sold Price increased by 5.9% from last month. The Average Sold Price also increased by 15.9% from last month. Based on the 6 month trend, the Average Sold Price trend was "Appreciating" and the Median Sold Price trend was "Appreciating".

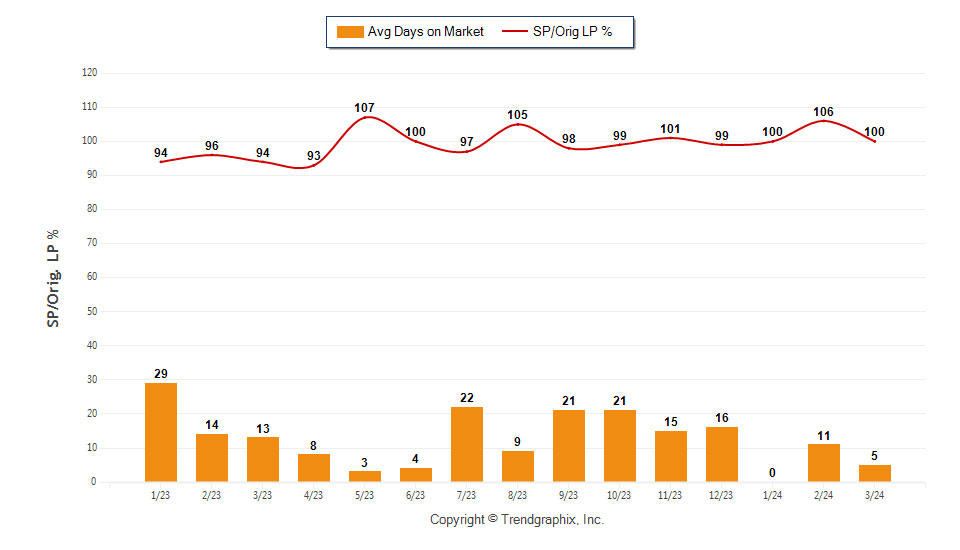

The Average Days on Market showed a neutral trend, a decrease of 61.5% compared to previous year. The ratio of Sold Price vs. Original List Price was 100%, an increase of 6.4% compared to previous year.

It was a Seller's Market

Property Sales (Sold)

March property sales were 5, the same as in March of 2023 and 66.7% higher than the 3 sales last month.

Current Inventory (For Sale)

Versus last year, the total number of properties available this month was higher by 1 units of 100%. This year's bigger inventory means that buyers who waited to buy may have bigger selection to choose from. The number of current inventory was up 100% compared to the previous month.

Property Under Contract (Pended)

There was an increase of 50% in the pended properties in March, with 6 properties versus 4 last month. This month's pended property sales were 50% higher than at this time last year.

All reports are published April 2024, based on data available at the end of March 2024, except for the today’s stats. Information and statistics derived from Northwest Multiple Listing Service. Neither the Board or its MLS guarantees or is in any way responsible for its accuracy. Data maintained by the Board or its MLS may not reflect all real estate activity in the market. Report reflects activity by all brokers participated in the MLS.

The Average Sold Price per Square Footage was Neutral*

The Average Sold Price per Square Footage is a great indicator for the direction of property values. Since Median Sold Price and Average Sold Price can be impacted by the 'mix' of high or low end properties in the market, the Average Sold Price per Square Footage is a more normalized indicator on the direction of property values. The March 2024 Average Sold Price per Square Footage of $691 was down 18.8% from $851 last month and up 11.6% from $619 in March of last year.

* Based on 6 month trend – Appreciating/Depreciating/Neutral

The Days on Market Showed Neutral Trend*

The average Days on Market (DOM) shows how many days the average property is on the market before it sells. An upward trend in DOM trends to indicate a move towards more of a Buyer’s market, a downward trend indicates a move towards more of a Seller’s market. The DOM for March 2024 was 5, down 54.5% from 11 days last month and down 61.5% from 13 days in March of last year.

The Sold/Original List Price Ratio Remains Steady**

The Sold Price vs. Original List Price reveals the average amount that sellers are agreeing to come down from their original list price. The lower the ratio is below 100% the more of a Buyer’s market exists, a ratio at or above 100% indicates more of a Seller’s market. This month Sold Price vs. Original List Price of 100% was down 5.7% % from last month and up from 6.4% % in March of last year.

* Based on 6 month trend Upward/Downward/Neutral

** Based on 6 month trend – Rising/Falling/Remains Steady

All reports are published April 2024, based on data available at the end of March 2024, except for the today’s stats. Information and statistics derived from Northwest Multiple Listing Service. Neither the Board or its MLS guarantees or is in any way responsible for its accuracy. Data maintained by the Board or its MLS may not reflect all real estate activity in the market. Report reflects activity by all brokers participated in the MLS.

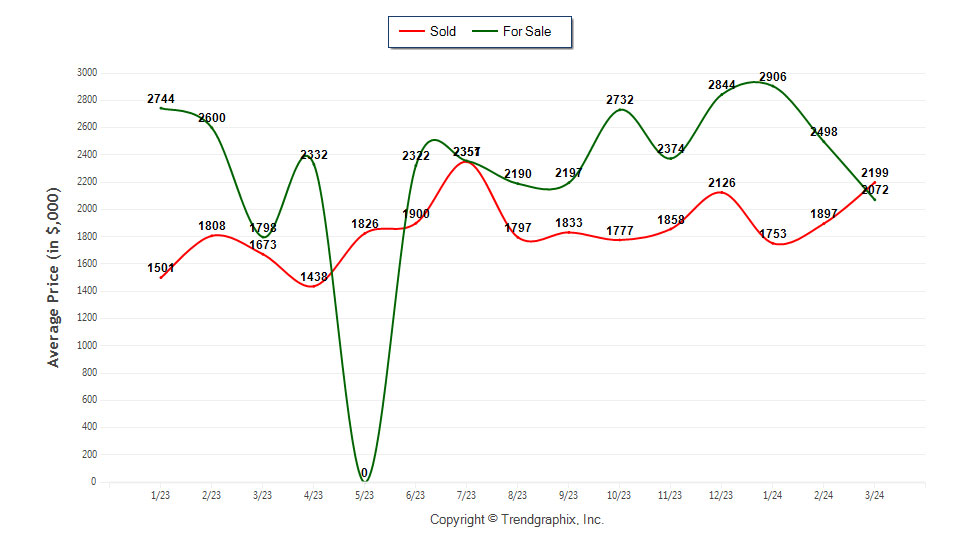

The Average For Sale Price was Depreciating*

The Average For Sale Price in March was $2,072,000, up 15.2% from $1,798,000 in March of 2023 and down 17.1% from $2,498,000 last month.

The Average Sold Price was Appreciating*

The Average Sold Price in March was $2,199,000, up 31.4% from $1,673,000 in March of 2023 and up 15.9% from $1,897,000 last month.

The Median Sold Price was Appreciating*

The Median Sold Price in March was $1,969,000, up 18.6% from $1,660,000 in March of 2023 and up 5.9% from $1,860,000 last month.

* Based on 6 month trend – Appreciating/Depreciating/Neutral

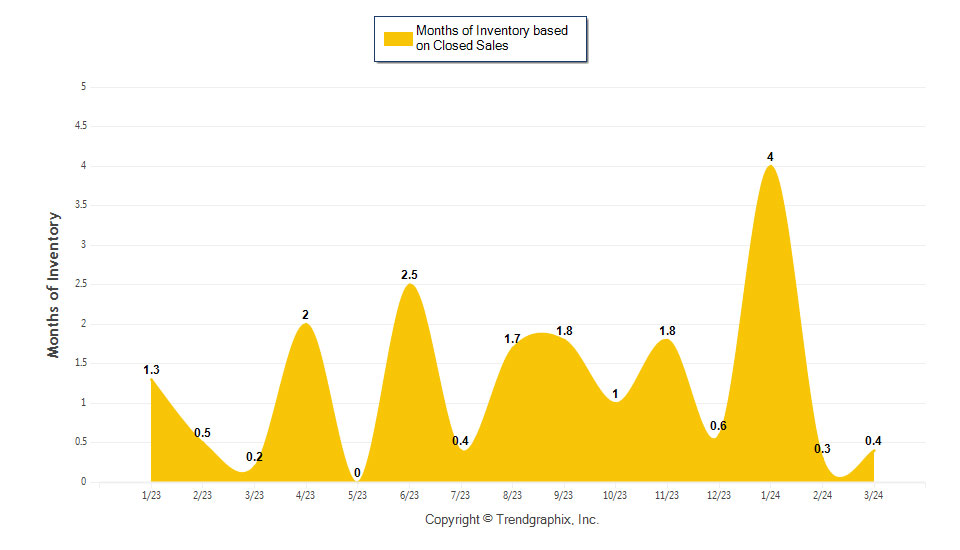

It was a Seller's Market*

A comparatively lower Months of Inventory is more beneficial for sellers while a higher months of inventory is better for buyers.

*Buyer’s market: more than 6 months of inventory

Seller’s market: less than 3 months of inventory

Neutral market: 3 – 6 months of inventory

Months of Inventory based on Closed Sales

The March 2024 Months of Inventory based on Closed Sales of 0.4 was increased by 100% compared to last year and up 30% compared to last month. March 2024 was Seller's market.

Months of Inventory based on Pended Sales

The March 2024 Months of Inventory based on Pended Sales of 0.3 was the same compared to last year and the same compared to last month. March 2024 was Seller's market.

All reports are published April 2024, based on data available at the end of March 2024, except for the today’s stats. Information and statistics derived from Northwest Multiple Listing Service. Neither the Board or its MLS guarantees or is in any way responsible for its accuracy. Data maintained by the Board or its MLS may not reflect all real estate activity in the market. Report reflects activity by all brokers participated in the MLS.

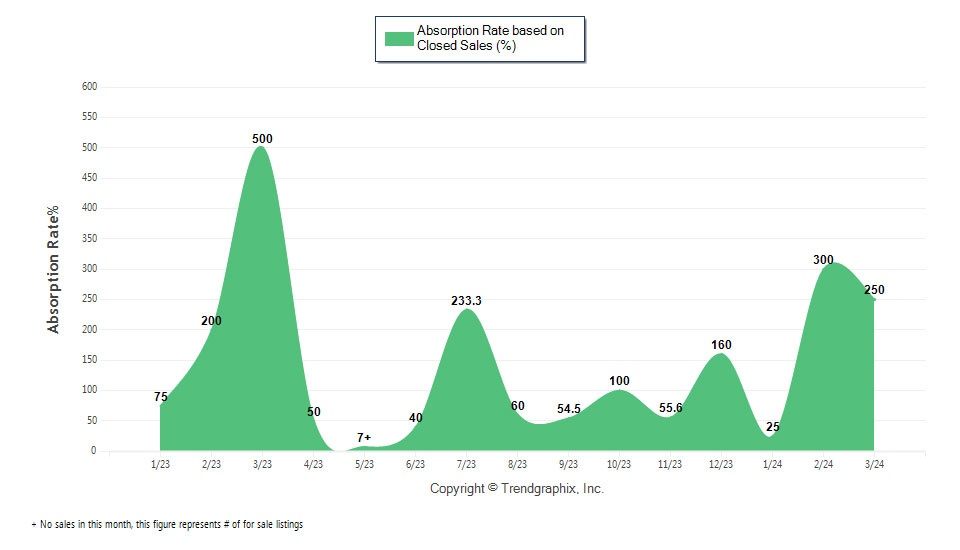

It was a Seller's Market*

Absorption Rate measures the inverse of Months of Inventory and represents how much of the current active listings (as a percentage) are being absorbed each month.

*Buyer’s market: 16.67% and below

Seller’s market: 33.33% and above

Neutral market: 16.67% - 33.33%

Absorption Rate based on Closed Sales

The March 2024 Absorption Rate based on Closed Sales of 250 was decreased by 50% compared to last year and down 16.7% compared to last month.

Absorption Rate based on Pended Sales

The March 2024 Absorption Rate based on Pended Sales of 300 was decreased by 25% compared to last year and down 25% compared to last month.

All reports are published April 2024, based on data available at the end of March 2024, except for the today’s stats. Information and statistics derived from Northwest Multiple Listing Service. Neither the Board or its MLS guarantees or is in any way responsible for its accuracy. Data maintained by the Board or its MLS may not reflect all real estate activity in the market. Report reflects activity by all brokers participated in the MLS.

You agree to receive property info, updates, and other resources via email, phone and/or text message. Your wireless carrier may impose charges for messages received. You may withdraw consent anytime. We take your privacy seriously.